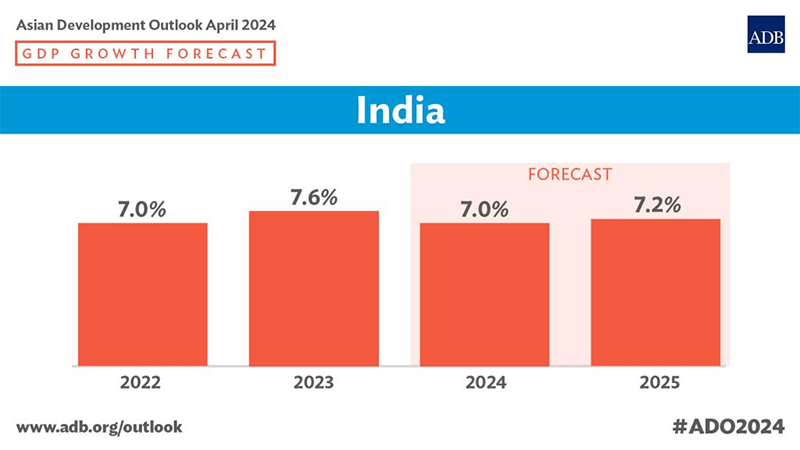

The Asian Development Bank (ADB) upgraded India’s gross domestic product (GDP) growth forecast for fiscal year (FY) 2024 ending on 31 March 2025 from 6.7% to 7% and 7.2% in FY2025, driven by robust public and private investment and strong services sector.

The forecast is part of the latest edition of ADB’s flagship economic publication, Asian Development Outlook (ADO) April 2024, released today. The triggers for growth in FY2024 will come from higher capital expenditure on infrastructure development both by central and state governments, rise in private corporate investment, strong service sector performance and improved consumer confidence. Growth momentum will pick up in FY2025 backed by improved goods exports and an increase in manufacturing productivity and agricultural output.

“Notwithstanding global headwinds, India remains the fastest growing major economy on the strength of its strong domestic demand and supportive policies,” said ADB Country Director for India Mio Oka. “The Government of India’s efforts to boost infrastructure development while undertaking fiscal consolidation and provide an enabling business environment will help in increased manufacturing competitiveness to augment exports and drive future growth.”

A healthy rise of 17% in central government capital expenditure in FY2024 compared to the previous fiscal year together with transfers to state governments will boost infrastructure investment. A new government initiative to support urban housing for middle-income households is expected to further spur housing growth. Private corporate investment is expected to get a boost with stable interest rates. With inflation moderating to 4.6% in FY2024 and easing further to 4.5% in FY2025, monetary policy may become less restrictive, which will facilitate rapid offtake of bank credit. Demand for financial, real estate and professional services will grow while manufacturing will benefit from muted input cost pressures that will boost industry sentiment. Expectations of a normal monsoon will help boost growth of the agriculture sector.

The government’s focus on fiscal consolidation, with a targeted deficit of 5.1% of GDP for FY2024 and 4.5% for FY2025, will enable the government to reduce its gross marketing borrowing by 0.9% of GDP in FY2024 and create further room for private sector credit. India’s current account deficit will widen moderately to 1.7% of GDP on rising imports for meeting domestic demand. Foreign direct investment will be affected in the near term due to tight global financial conditions but will pick up in FY2025 with higher industry and infrastructure investment. Goods exports will also be affected by lower growth in advanced economies but pick up in FY2025 as global growth improves.

Unanticipated global shocks such as supply line disruptions to crude oil markets and weather shocks that impact agriculture output are key risks to India’s economic outlook. – Wam

Leave a Reply